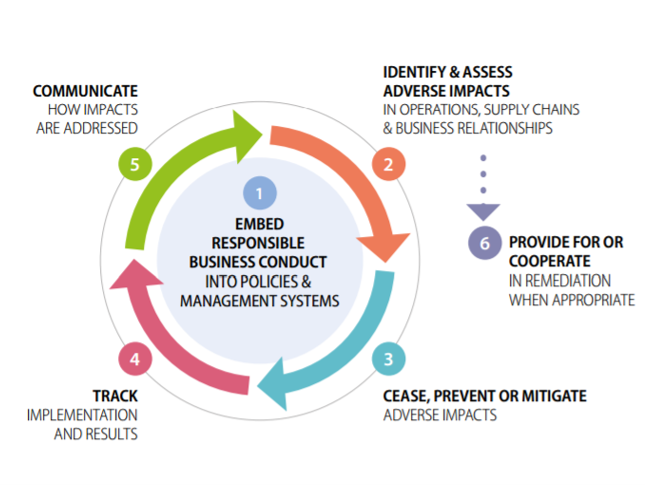

Right now, many people in my “ecosystem” are talking about the new reporting requirements emanating from the Corporate Sustainability Reporting Directive (CSRD) and its accompanying reporting standards European Sustainability Reporting Standards (ESRS – See previous Newsletter here). This and other directives, such as the sustainability due diligence regulation, will imply a lot more work – but hopefully also a helpful push or pull for companies who want to become more sustainable.

This newsletter will be a little different as it will be devoted mainly to one theme, namely sustainable business models.

(Towards the end of this Newsletter, I also comment on the current Africa Climate Summit, and the upcoming United Nation General Assembly + share an interesting article on social sustainability in finance).

What is a sustainable business model?

Books have been written on the subject and there are of course many different definitions out there (and some even question whether there are any truly sustainable business models). Usually a Sustainable Business Model refers to a way of conducting business that generates a value to stakeholders without depleting the resources used to create that value (read more e.g. here or here).

For now, my take is that we need to quickly shift how we do things, and the most efficient way of shifting is to also accept that most companies or business models will not be perfect. Not all owners (shareholders) are prepared to go as far as Patagonia who claim to be “in business to save our home planet” and have transformed its ownership to a trust that will ensure that profits will be used to combat climate change and protect underdeveloped land (read more). And if you are not prepared to go all the way, taking the train is usually a more climate smart choice than an EV (electric car), but an EV is normally a much better option than travelling with a petrol or diesel fuelled vehicle. There are “shades of grey” in action that are better than inaction. In other words, in my view it’s more helpful to discuss sustainable business models in terms of “how much”, rather than “yes or no”.

According to a Norwegian survey from 2021, 8 out of 10 companies believed that their business model has to change (read more) and from talking to companies in diverse places such as Sweden, South Africa, Kenya and Albania only in the last 6 months, I would say that change is happening all over. In my experience, there are different reasons why companies believe they need to change. For example:

- For some companies it’s about sustainability challenges (such as climate, or crime) that threaten their current way of doing business

- Customers -not least those who work with public procurements or with B2B with large corporations subject to harsh reporting requirements, but also those sell products or services directly to consumers

- Investors expect more sustainability and those with a positive impact can often access financing at lower rates, or are valued at a higher price

- Workers prefer working for companies that are sustainable and have a higher purpose (read more about “climate quitters” in the UK).

- Finally, some companies are considering change due to regulations.

However, regarding the last category, I would maintain that disclosing sustainability information is not the same as revisiting business models. This quote from the Quest for Sustainable Business Model Innovation sums it up quite well, I think:

“There has been notable progress in defining metrics for materiality and sustainability and supporting them with increasingly relevant and better-quality data, but this has inadvertently created an overemphasis on reporting and compliance per se, rather than on strategy, action, and advantage.”

Usually, a more sustainable business model is expected to create business value. I also meet owners or CEO’s, however, who feel that it is their responsibility to adapt and/or change their business models. As one leader I spoke to put it: “It makes me feel better and, besides, it makes my daughters proud of me”. In any case it would need to generate profit, otherwise it can’t be sustained.

There are also different ways in which we can approach what a sustainable business model is. Let me for the purpose of this newsletter divide them into four categories (the examples below can surely be questioned, and though I don’t know most of the corporations that well, I think mentioning them will give you an idea of what I mean):

- Companies that have intentionally developed a product (or service) that contributes positively to a sustainable transition, such as H2Green Steel, Vestas, Northvolt, EasyMining, Tesla etc.

- Companies which have changed some or all their products or the way their products are produced. Examples include companies such as Scania and Volvo (cars & trucks), Unilever, Electrolux, IKEA, Patagonia, Boliden to mention a few. These companies have transformed part of their product(ion) lines so that it leaves a minimum footprint, often mainly in terms of climate but they also consider other environmental aspects and social sustainability

- Companies that offer services that fit well with for example a more circular transition. Typical examples would be Blocket ( a platform for trading used goods), Airbnb and M-PESA (Vodacom/Safaricom)

- Companies that have acted sustainably ever since inception, regardless of the broader “sustainability buzz”. This would include many small-scale organic farmers, companies that repair broken products or recycle used goods. These companies tend (in my view) to be more common in developing countries.

We tend to look more at sustainability in relation to nature (climate footprint and to what extent virgin resources are used) but with an increasing interest – not least from investors – in social sustainability, I find that a growing number of companies and other organisations are asking themselves if and how they can run their business in a way that not only avoids violating people’s rights, but actually makes a positive change for stakeholders.

The discussion around sustainable companies at some point often becomes political (not least in the US, as we have written about in a previous newsletter), where some argue that sustainability infringes on the capitalist economic model. In my view almost all economies are already regulated in one form of the other and I’m not sure I see why for example sustainability disclosures would make much difference (to that system). However, I admit that questioning the economic system plays a certain role when we look at sustainability as the current economic system is largely dependent on e.g. fossil fuels and other virgin resources and does too little to address other sustainability challenges. We need a transition to a system where we – corporations, governments and civil society – take better care of each other and of our planet.

This leaves me thinking that what differentiates a “normal” company from a company aspiring to introduce a more sustainable business model, could be that the latter acknowledges and actively tries to drastically 1) reduce its negative impact on people and planet, and 2) to some extent contribute positively to people or planet. As the companies above are or are at least aspiring to do. To me, it can’t only be about results –aspiration ( or intention) also matters.

Feed-back welcome!

Two events you may wish to know more about – and a report on social issues in sustainable finance!

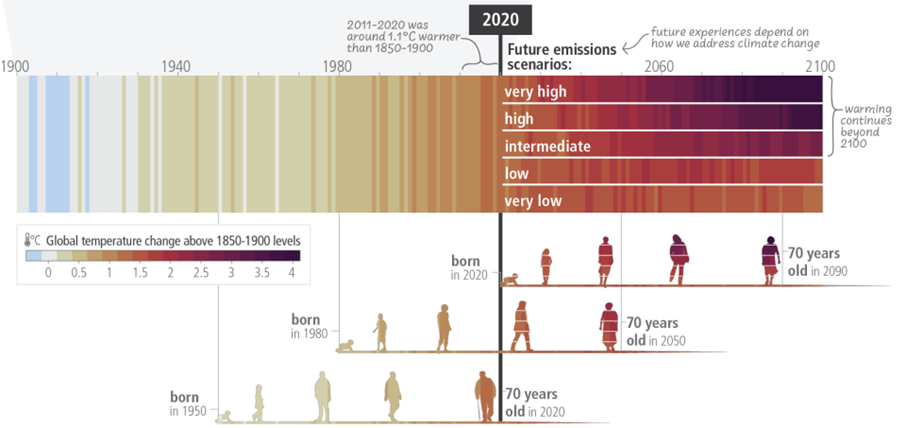

Right now, the African Climate Summit is underway in Nairobi. It’s a warm-up for COP 28 – but perhaps also a little more than that. Key issues include climate finance, energy transition, innovative technologies, nature based solutions and, not least, youth engagement. Africa’s population and economies are fast-growing and discussions and developments in Africa will, I think, play an increasingly important role in the years to come. How will, for example, the deposits of raw material (“virgin resources”) – including fossil fuel, be dealt with?

The discussions that take place at board rooms and seminars around new economic models, aiming at a both greener and more just future, also takes place in different places in Africa. Keep an eye on it – I think we have an exciting (but perhaps bumpy) road ahead when it comes to the broader discussions on sustainability in companies and sustainable economic systems!

Secondly, the United Nations General Assembly is about to meet in New York later in September. The theme this year is “Rebuilding trust and reigniting global solidarity: Accelerating action on the 2030 Agenda and its Sustainable Development Goals towards peace, prosperity, progress and the sustainability for all.” Trust. That is something we desperately need, both between people and nations. Not likely that UNGA will manage to rebuild this trust, but meeting and talking is a good start. And in the meantime, the words from UN Global Compact regarding UNGA may be able to inspire action: “The world is in urgent need of solutions to the world’s most pressing crises that only the private sector can deliver. This need represents a burgeoning market for business innovation, creativity and new technologies. Private sector leadership and multi-stakeholder partnerships are vital to creating the transformational change that humanity so desperately needs.”

Finally, I have been talking about the Just and Green transition in previous newsletters. I’m currently involved in a couple of assignments where we explore different aspects of this transition and what it can imply for different organisations and businesses. I will return to this later but let me share this interesting article that convincingly makes the case for why social issues and green issues go together: “From fragmentation to integration: Embedding Social Issues in Sustainable Finance”

Thoughts and feed-back always welcome. Take care!

company, both in terms of profits and in terms of the value it creates for its different stakeholders. The success can be measured by an increased score on the company’s

company, both in terms of profits and in terms of the value it creates for its different stakeholders. The success can be measured by an increased score on the company’s  Late January I made a presentation at a Round Table at the Swedish Embassy in Pretoria. The Round Table was about challenges and opportunities with regard to a “Just Green Transition”, and more specifically how Sweden and climate smart products developed by Swedish companies, can contribute to a greener and more just future. During the Round Table we spent some time talking about the development in Europe regarding increased regulation around sustainability disclosures (e.g. the Taxonomy, CSRD and the coming Corporate Sustainability Due Diligence Directive). Not everyone was convinced about the greatness of disclosure, and I personally agree that regulation on disclosure will not be enough.

Late January I made a presentation at a Round Table at the Swedish Embassy in Pretoria. The Round Table was about challenges and opportunities with regard to a “Just Green Transition”, and more specifically how Sweden and climate smart products developed by Swedish companies, can contribute to a greener and more just future. During the Round Table we spent some time talking about the development in Europe regarding increased regulation around sustainability disclosures (e.g. the Taxonomy, CSRD and the coming Corporate Sustainability Due Diligence Directive). Not everyone was convinced about the greatness of disclosure, and I personally agree that regulation on disclosure will not be enough.